In partnership with Farmnews, LIKE Inteligência monitors Brazilian agribusiness in the media, and one of the highlights between August 25 and 29 was the record number of defaults!

LIKE Inteligência’s monitoring of agribusiness aims to highlight to our readers the most important events and their positive and negative repercussions in the media. Every week, we will highlight the main discussions involving agribusiness in the country’s political and economic perspective!

🔴 Negative Narratives:

• The Reciprocity Law proposed by the Lula government against the U.S. sparked negative reactions from the productive sector. Stakeholders such as the FPA (Agribusiness Parliamentary Front), Cecafé, CNI, and Abipesca called for caution and dialogue, warning about risks of escalating the conflict.

• The “Hidden Carbon” Operation exposed the infiltration of the PCC (First Capital Command criminal faction) in the fuel sector, with allegations of farmland and mill acquisitions for money laundering and tax fraud.

• The Soy Moratorium continued to generate uncertainty and controversy. A court injunction suspending Cade’s decision produced strong repercussions and polarization.

• China admitted it may increase soybean purchases from the U.S., raising concerns among Brazilian producers about a possible bilateral agreement.

🟢 Positive Narratives:

• Market diversification in agribusiness remains a highlight in response to the tariff crisis. The Brazilian mission to Mexico generated highly positive coverage, particularly for beef exports.

• The government finally moved forward with domestic food purchases to absorb perishable products impacted by tariffs.

• Growing Chinese demand for Brazilian agribusiness products gained attention, particularly soybeans, boosting prices and pressuring U.S. producers.

• Biofuels investment—especially corn ethanol—continues to expand, with major players like Raízen, Inpasa, and Amaggi announcing multi-billion investments.

📊 Key Indicators

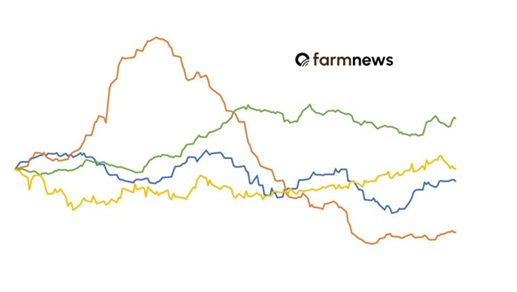

• Mentions of Agribusiness: 110,260 (+7% vs. previous period)

• Mentions of U.S.–Trump–Bolsonaro Crisis: 254,820 (+8%), with ~12 k directly referencing agribusiness

• Overall Sentiment: Negative (35%), Neutral (48%), Positive (17%)

📍 Peaks in Repercussion:

• Aug 26 – Alerts about a possible U.S.–China soybean agreement and escalation of the “Soy Moratorium War” after the injunction against Cade (88.5 k posts)

• Aug 27 – Brazilian beef gains traction in Mexico (76 k posts)

📎 Dominant Channels

• News: G1, CNN, Metrópoles, Valor, Gazeta do Povo, Folha de S.Paulo, O Globo, Estadão, MoneyTimes, Reuters, Jota.info

• Instagram: @LulaOficial, @CNNpolitica, @MidiaNinja, @portalG1, @GreenpeaceBrasil, @monicaseixaspsol

• X (Twitter): @erikahilton, @laurasabino, @Metropoles, @PedroRonchi2, @AprosojaBrasil, @GreenpeaceBR

• Agribusiness media: Globo Rural, AgroEstadão, AgFeed

🗣️ Key Stakeholders in the Spotlight

Positive:

• CNA: remained in the spotlight, with multiple spokespersons defending the sector in the Soy Moratorium case.

• Roberto Perosa (Abiec): led the business delegation to Mexico, calling the country the “next big opportunity” for Brazilian beef, with expectations for 14 new plants to be approved.

• Geraldo Alckmin: key political figure on the Mexico mission, positioning himself as a voice of balance and dialogue amid the tariff crisis.

Critical or Polarizing:

• Environmental groups (Greenpeace, Imazon): maintained a critical stance regarding the Soy Moratorium after the injunction against Cade.

• De Olho nos Ruralistas: critical outlet published six more pieces linking agribusiness leaders to the “coup” and the PCC.

in addition to the main news about Brazilian agribusiness in the media, Brazilian beef exports reached a new high in July 2025, driven by increased demand from China. Brazilian beef exports reached a new high in July 2025, driven by increased demand from China. Brazilian beef sales in July 2025 totaled 276,880 metric tons, up 16.7% from the previous year Click here and check it out!

Fabrício Peres also discuss about the invisible cost of a wek reputation in agribusiness. Access to read it

Click here to receive Farmnews studies via WhatsApp!